Delegation of foreigners to Belgium is very beneficial for Polish employers. Without a doubt Belgium is a state that is in the forefront of the most developed European countries. A lot of Polish entrepreneurs delegate their staff to Belgium. Why? Because of the huge demand for construction services and high profits. This solution makes it easier for employees outside the EEA (European Economic Area). The employee does not emigrate to another country, but is only temporarily delegated. Belgium employers appreciate Polish construction companies because of their punctuality and accuracy.

Delegation of foreigners to Belgium can be very profitable because of the very large number of construction orders in the labor market

If we want to avoid trouble, you should know all with the formalities that must be completed before delegating your employee. Despite the fact that the employee is delegated from Poland. And employee is not citizen of EEA, there are some concessions. The only condition is that the employee fulfills the following things in total:

• The employee has the right or permission to reside for more than three months in one of the EEA (European Economic Area) countries;

• Naturally the employee must also have a document certifying a work permit in one of the EEA member states. But a term of importance must be on the whole period of work carried out in Belgium. For example, your employee has a work permit in Poland, which is relevant for another 4 months. You can easily delegate an employee to work in Belgium, for example, for a period of 3 months;

• Has a permanent employment contract;

• Is an owner of a passport or residence permit for a period corresponding to the minimum work period, carried out in Belgium.

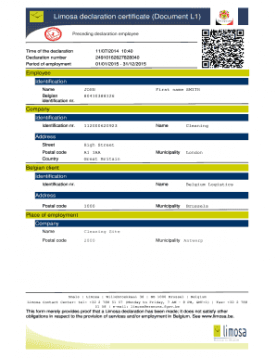

An employer who delegates an employee to Belgium should first fill in the Limosa declaration. You should remember its name if you are dealing with foreigners in Belgium.

Every person that is free from paying on Belgian’s social security and comes to Belgium for a certain time, must have a certificate of the declaration of Limosa-1. Failure to comply with the requirements of this declaration may impose penalties or high administrative fines.

What is a Limosa declaration?

What is a Limosa declaration?The Limosa declaration is a filing obligation, effective from April 1, 2007. This declaration was introduced by the Belgian government to simplify the employment of delegated employees. Special attention was paid to their laws and working conditions.

Completing the Limosa declaration simplifies administrative duties in Belgium, including:

The Limosa declaration is the first step towards legitimate work in Belgium in accordance with European rules. This is a legal obligation. Failure to comply with this obligation may result in criminal or administrative sanctions. Employers, their representatives, as well as employees are subjects of prosecution.

The employer after completing the mandatory Limosa declaration no longer needs to prepare any Belgian documents for a specific administrative unit that relate to:

You are improving your position in the Belgian market by filling out the Limosa declarations. Customers and customers will respect you more and you will become a reliable partner.

Definitely the company establishes a natural person which will supply information to the Belgian Labor Inspectorate on the employment of employees, delegation and performing work. The representative is indicated in the Limosa declaration. The tasks of the representative follow from the law of March 5, 2002. (On the working conditions and employment of employees delegated to Belgium and their observance in accordance with directive 2014/67/UE).

It often happens that the Belgian inspector checks for the fact that the company does not keep double documentation, asks the General Labor Inspector about the organization of a special inspection. There are following examples of crimes or offenses:

• No Limosa declaration

• Attracting people who falsely carry out activities at their own expense (social fraud and fraud: level 4)

• Employee remuneration (level 2 or 4 in case of dumping)

• Belgian Rules (Level 3)

• Obstruction (level 4)

• Employee remuneration in accordance with the rules of collective agreements

• Lack of accident insurance at work

• No declaration in ONSS

Undoubtedly sanctions are divided into the following levels:

Attention! Penalties will be multiplied by the number of employees affected by the violation of the law. The courts can also confiscate and sell the property of your company (construction equipment, car, etc.). The amount from the sale does not always go to the account of the fine.

An employer who decides to do the delegation of employees to Belgium must comply with the Belgian Labor Code. Legal regulations govern the basic rights of employees, such as those arising from the Law of Delegation on March 5, 2002:

Non-observance of these rights by the employer threatens to impose sanctions on him

By coordinating the social security systems in the EEA and in Switzerland it is possible to pay contributions in the state where the employee performs the work. The employer must meet the necessary prerequisites for being subject to the Polish social security system. In this case he will have the opportunity to receive a certificate of the so-called A1. Obtaining of such document exempts from the obligation to pay contributions in the Belgian Department of Social Insurance (Office National de la Sécurité Sociale, ONSS).

Each employee is on a delegation, must have a European health insurance card.

Employees who are insured in Poland are entitled to use insurance in Belgium. The employer must ensure that each of employee has proof of the existence of medical insurance in Poland. In this case each of the them will to be sure that in case of such need they will receive free medical assistance.

A company that decides on the secondment of foreigners in Belgium should be familiar with the tax laws in order to avoid double taxation. In accordance with applicable European directives, the salary of a delegate may be taxed only in Poland, but not in each situation.

The law about income tax on individuals dated July 26, 1991, decides on which country a person should carry out a tax on personal income. Bilateral international agreements of the avoidance of double taxation also remain in the meaning. In Art. 3 the law on personal income tax found next: “individuals, if they have a place of residence in the territory of the Republic of Poland, are subject to mandatory tax on the amount of their income (income), regardless of the location of the sources of income (unlimited tax liability). Individuals residing in the territory of the Republic of Poland who have an unlimited tax liability are considered tax residents. A taxpayer is considered as a tax resident in Poland if:

– the center of his interests is on the territory of Poland, personal or economic (center of vital interests);

– lives longer than 183 days in the tax year in the territory of Poland.

Some customers require companies to delegate additional documents that do not belong to the core group of documents. An example of this is Construbadge or otherwise the construction worker ID. Construbadge is a document that identifies workers at construction sites in Belgium. Some of the foreign clients require these documents from Polish entrepreneurs. After registration, you receive a letter from the Fbz-fse Constructiv institution containing the access code for registration in the FSE application (Fonds de securite d’existence – Foundation for Security of Existence, the purpose of issuing Construbadge documents to employees).

Delegation of foreigners to Belgium calls on the employer’s side to fulfill all the formalities even for a short time. Please note that the link provides the employee with working conditions similar to those of the country to which the employee delegates. It is necessary to determine the right place of taxation and the tax of employee’s salary.

There some changes in connection with the introduction of the EU directive. The Belgian Labor Inspectorate requires the authorities of the Member States to verify the correct implementation of the key conditions of remuneration and employment. It is referred to in the Directive 96/71/EC on specialists. Because of this, more and more often requires the submission of a set of documents in French or Dutch languages. Deficiencies or irregularities can lead to court charges or high administrative fines.

Respected customers, we invite you take advantage of professional using services of our company at areas of accommodation foreigners at Belgium. We specialize in supporting companies from various sectors, including construction in the implementation of contracts.

Also we offer technical and administrative support, including translation of the necessary documentation. We collect the necessary documents to understand the situation of the enterprise every day. And we ensure the formal correctness of the actions are taken. The secondment of foreigners in Belgium can be a simple process if you use the services of our company.

The article: «The delegation of foreigners in Belgium» was written by

Natalia Poprawa – [email protected]

Michał Solecki – [email protected]

Translator by Vladimir Slipets